"Our work with Growthack was about much more than just SEO - it was about truly understanding our buyers and bringing our brand to life in a way that resonated with them. By mapping out key personas and creating a content strategy that spoke directly to our audience’s needs, we transformed our website into a vehicle for growth."

Scale your SaaS or Fintech with data-driven SEO

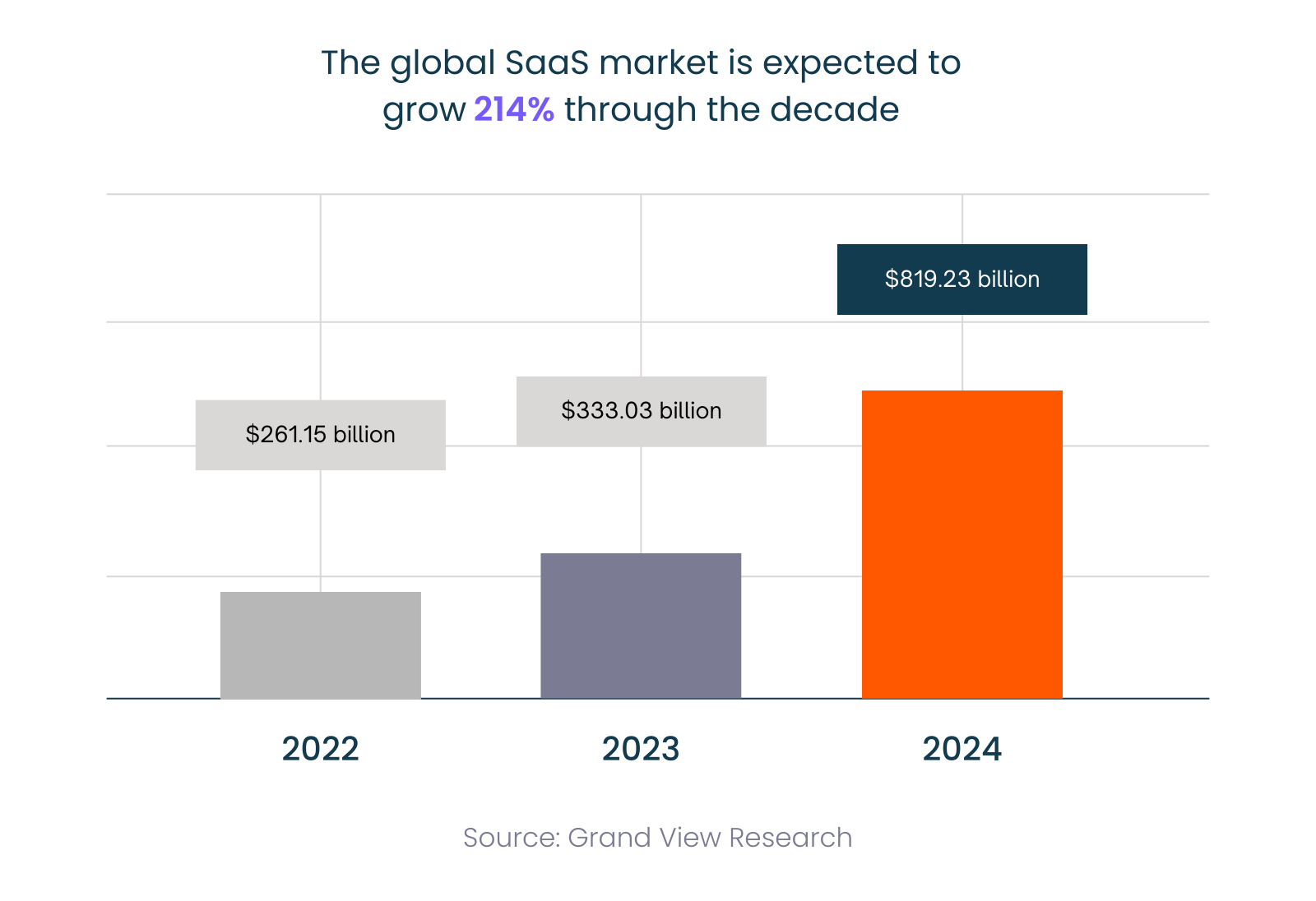

The Fintech and SaaS industries are growing, with startups using technology to disrupt traditional software and services. However, launching a product takes more than just great engineering and design. The key ingredient for scalable growth is data-driven marketing.

By using customer data and analytics to understand users’ interests and behaviours, we can leverage SEO campaigns to reach high-value target audiences with relevant messaging and experiences across their journey.

Challenges in SaaS and Fintech marketing

Building trust with customers

Gaining customer trust is critical yet difficult for both SaaS and Fintech companies. Many consumers are sceptical of newer digital products and services.

Useful trust-building tactics include:

- Educational content on how the products work and their benefits

- Visual product demonstrations plus FREE trials availability

- Community forums and reviews for sharing customer experiences

- Transparent communication around security and privacy practices

By showcasing expertise, delivering measurable value quickly, and having genuine customer conversations, SaaS and Fintech providers can overcome scepticism and build loyalty.

Overcoming market fragmentation

Both SaaS and Fintech remain heavily fragmented spaces with many niche players targeting specific segments. This brings challenges like:

- Higher customer acquisition costs due to narrow targeting

- Overlapping capabilities leading to duplicated efforts

- Intense competition even within micro-verticals

Strategies to overcome fragmentation include:

- Start by dominating a niche, then expand into adjacent categories

- Provide an integrated platform consolidating disparate tools

- Build a consistent master brand across expanding products

- Partner with complementary services for unified solutions

Trusted by leading brands nationwide

Victoria, elementsuite (acquired by Zellis)

" Organic growth directly contributed to millions in potential revenue, securing enterprise leads and closed deals. A revamped website, AI-driven content, and buyer-led UX strategy strengthened market positioning. Enterprise HR SEO leadership achieved top rankings for high-intent commercial keywords."

UK Digital Excellence Awards, Stand Out Campaign

"I have worked with Growthack for just over a year now, utilising their expertise, advice and management of our SEO and PPC channels. They are a real pleasure to work with, clearly experts in their field and have had an enormous impact on the quality and volume of traffic to our SaaS product."

Nicholas, Global Fintech SaaS Company

“I approached Growthack already knowing of their capabilities from previous engagements- and once again, they have delivered. The LinkedIn campaign framework and management have played a key role in VOSS’ growth”

Debbie, VOSS

3 Key pillars of data-driven marketing

Utilise customer insights to boost user acquisition and increase lifetime value

Data Infrastructure

Collects customer data, connecting raw information to visualisation tools using analytics. Data protection ensures compliance, privacy, and security.

Analytics

Reveals past trends, diagnostic analytics refines strategies, predictive analytics forecasts future trends, and prescriptive analytics optimises strategies.

Execution Channels

Use segmentation to execute targeted messaging, use data insights to optimise campaigns, individualise onboarding, and create data-driven retention strategies.

Why marketing is important for Fintech and SaaS product?

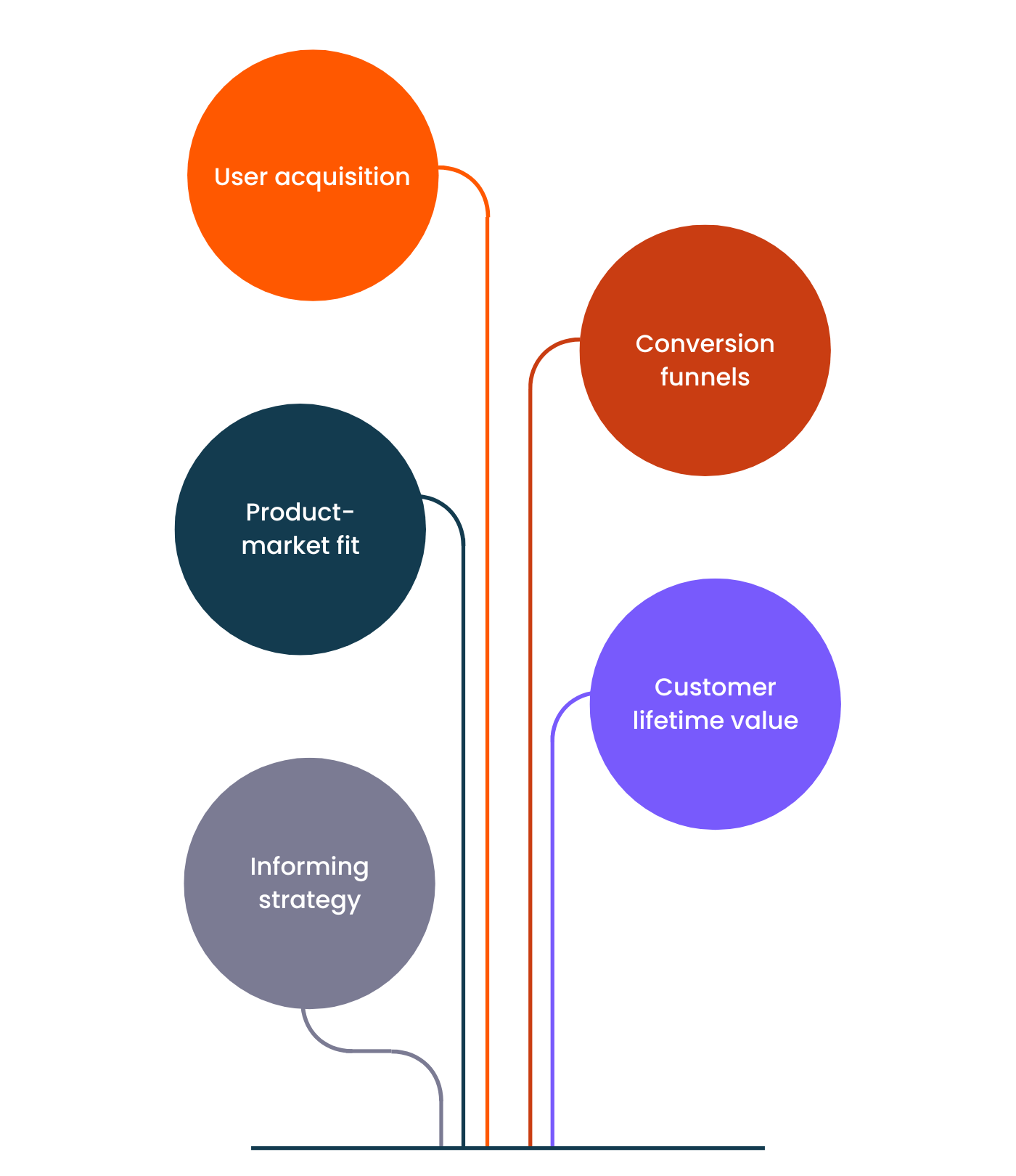

While facing an uphill battle against established companies. You must rapidly acquire users and demonstrate value. Data-driven marketing makes this possible by:

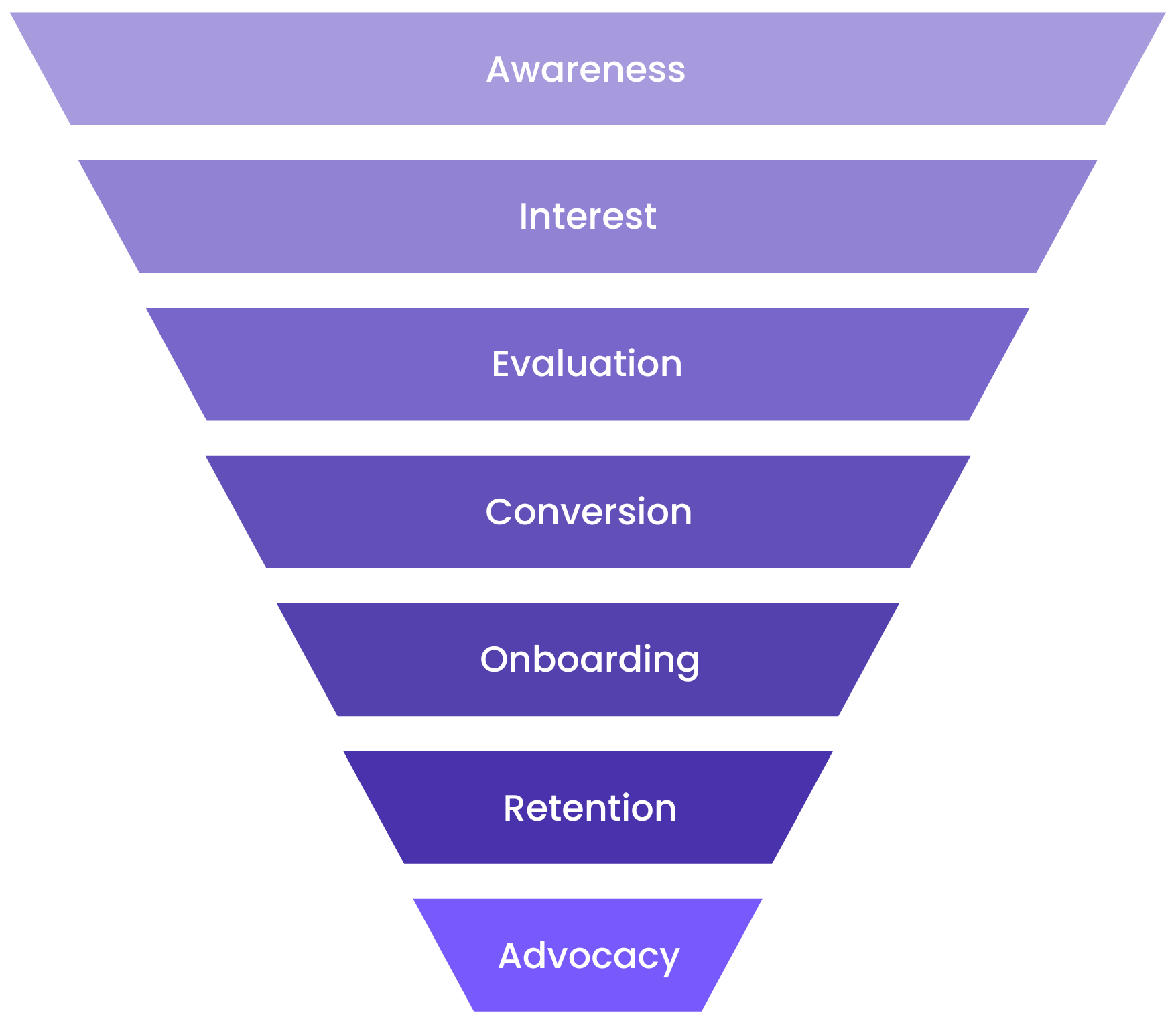

Optimising conversion funnels – Pinpoint and eliminate friction points losing customers.

Accelerating product-market fit – Rapidly test new features, pricing models, and campaigns with live user data.

Maximising customer lifetime value – Build individualised experiences that delight users and promote loyalty.

Informing strategy – Continuously refine targets and allocate resources using performance data.

Without data-driven marketing, you’re essentially flying blind. The narrow view leads to wasted budgets and a failure to achieve product-market fit.

Let's have a brief call to discuss how we could help.

Get Started

How SEO & PPC can help your SaaS or Fintech company

6 strategies and tactics used in SaaS and fintech marketing

- Micro-segmenting audiences based on attributes like demographics, technographics, and buyer lifecycle stage

- Personalising content and product experiences for each customer segment

- A/B testing different marketing messages, offers, landing pages, and creatives

- Leveraging lookalike modelling to find new audiences similar to current customers

- Automating workflows to engage users based on actions and behaviours

- Continuously optimising campaign elements and channels based on performance data

This approach provides significant benefits, including:

- Higher conversion rates from targeted and relevant messaging

- Increased customer lifetime value through individualised experiences

- Improved marketing ROI by focusing budgets on high-intent segments

- Enhanced brand loyalty built on top-notch customer service

- Faster growth by entering new markets and expanding share of wallet

Developing a marketing strategy

Any SaaS or Fintech company that wants to thrive in acquisition and growth has to have a strong marketing plan.

Identifying target audience and segmentation

Defining the target audience involves assessing demographics, psychographics, behaviours, and needs. Useful segmentation dimensions include:

- age

- income

- geography

- company size

- user persona

- shopping habits

Each resulting segment can be targeted with specific strategies.

Setting business goals

Well-defined objectives provide direction and alignment. Common examples include acquiring 2,000 customers in 12 months, achieving £500k of revenue in Year 1, and doubling monthly active users in 6 months. Objectives should be specific, measurable, achievable, relevant, and time-bound.

Defining key performance indicators (KPIs)

KPIs track progress on objectives. Common SaaS/Fintech KPIs include customer lifetime value, churn rate, customer acquisition cost, sales cycle length, and net promoter score. The right KPIs connect to overall success metrics like

- Growth

- Profitability

- Customer satisfaction

What do SaaS and Fintech companies gain from SEO?

SEO delivers several key benefits for SaaS and Fintech brands looking to drive growth:

- Improved discoverability – Ranking for commercial and informational searches helps brands get found by more relevant users actively looking for solutions.

- More cost-efficient than paid ads – SEO brings targeted organic traffic over the long-term, whereas paid search requires ongoing spending.

- Authority and trust – Ranking highly for commercial and informational searches shows SaaS/Fintech brands understand their industry and users’ needs. This builds credibility and trust by signalling:

- Expertise in the space

- Addressing user pain points

- Commitment to educating-providing value, not just selling

- Lead generation – Getting discovered earlier and more often in the buyer’s journey leads to more sales-ready leads.

In summary, SEO should be a pillar of any growth strategy for SaaS and Fintech companies. It pays dividends both immediately and over time.

Why should SaaS/Fintech companies invest in Paid Ads?

Paid ads provide complementary benefits to SEO:

- Faster impact – Paid ads drive results immediately, while SEO takes time. Quickly test messaging.

- Targeted exposure – Target by role, company, and interests to reach niche B2B buyers.

- Flexibility – Adjust targeting and messaging in real-time based on performance.

- Retargeting – Remarketing keeps brands top-of-mind by re-engaging visitors across sites.

- New customer acquisition – Use lookalike audiences to find new prospects interested in your offerings.

Paid search and social complement SEO efforts by expanding reach. The combination provides both immediate and long-term visibility.

Accelerate customer acquisition

Clicks, conversions, sales — growth’s the name of our game. Talk to us about your big ambition and we’ll take it from there.

Send us a brief

Your results, our expertise.

We’ve received multiple awards and recognitions for our team, clients, and partners.

“This went beyond SEO and aligned positioning, messaging, content, and design to drive business growth. Real results with direct SEO-attributed revenue and acquisition. Growthack delivered a comprehensive approach, including developing a new website to establish a strong foundation.”

“The campaign demonstrates a strong strategic approach, clearly aligning SEO with business growth beyond standard keyword rankings. Results achieved within 18 months are outstanding, including a direct impact on lead generation and revenue.”

“This website delivered remarkable results, with our team demonstrating excellent budget management. Our ability to optimise ad budget allocation has returned impressive outcomes with the integration of digital data in shaping product decisions.”

Address: Growthack Ltd, 31 Park Row, Nottingham NG1 6FQ

Platforms

About Growthack

Copyright © 2020 – 2025. Registered in England and Wales No. 12868240. VAT Reg GB392684357.

Copyright © 2020 – 2025. Registered in England and Wales No. 12868240. VAT Reg GB392684357.